2021 China Biopharma Global Transactions and IPOs Review

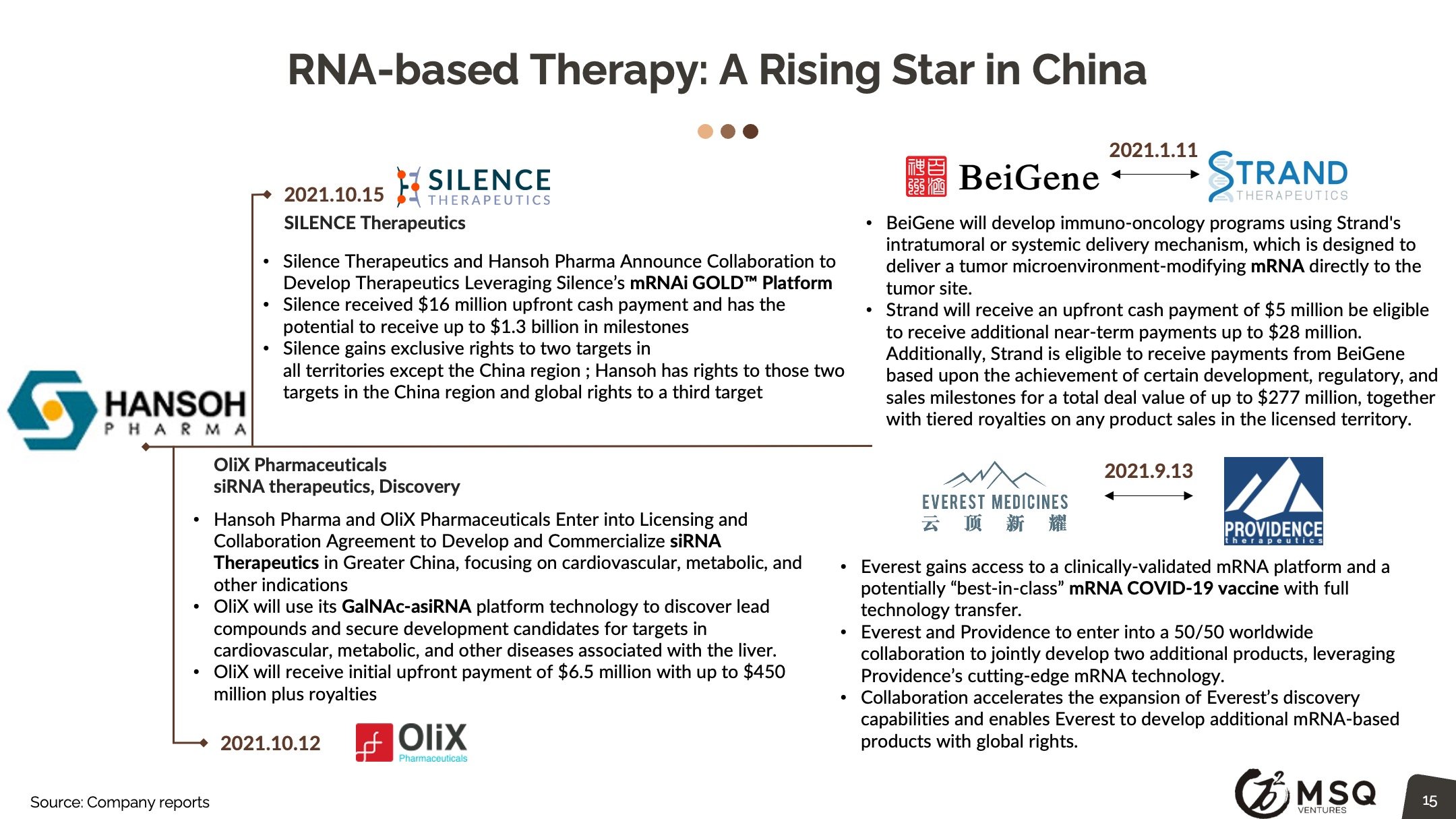

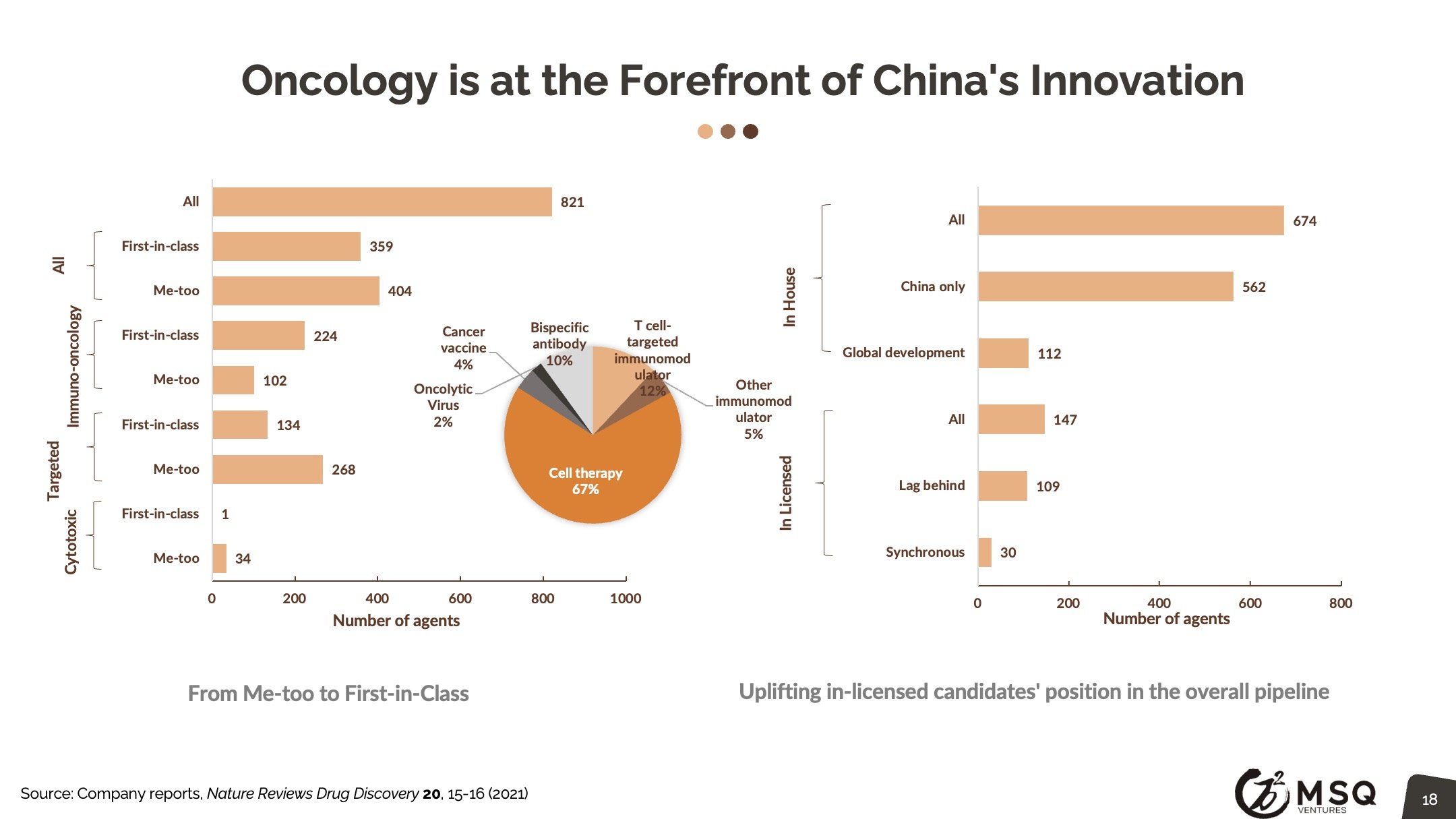

Our MSQ’s viewpoint for China Biopharma 2022 deal outlook will likely see investments in high growth areas across all the subsectors. Pharma is expected to continue investing in oncology as well as cell and gene therapy, but also in other areas such as neurology and cardiology as developments there attract greater interest. Technologies such as mRNA /RNAi have already begun to gain more traction. Larger companies will look to further diversify their portfolios and into innovative technology platforms. As China Biopharma grows, more global deals, in addition to gaining regional rights, will be expected.

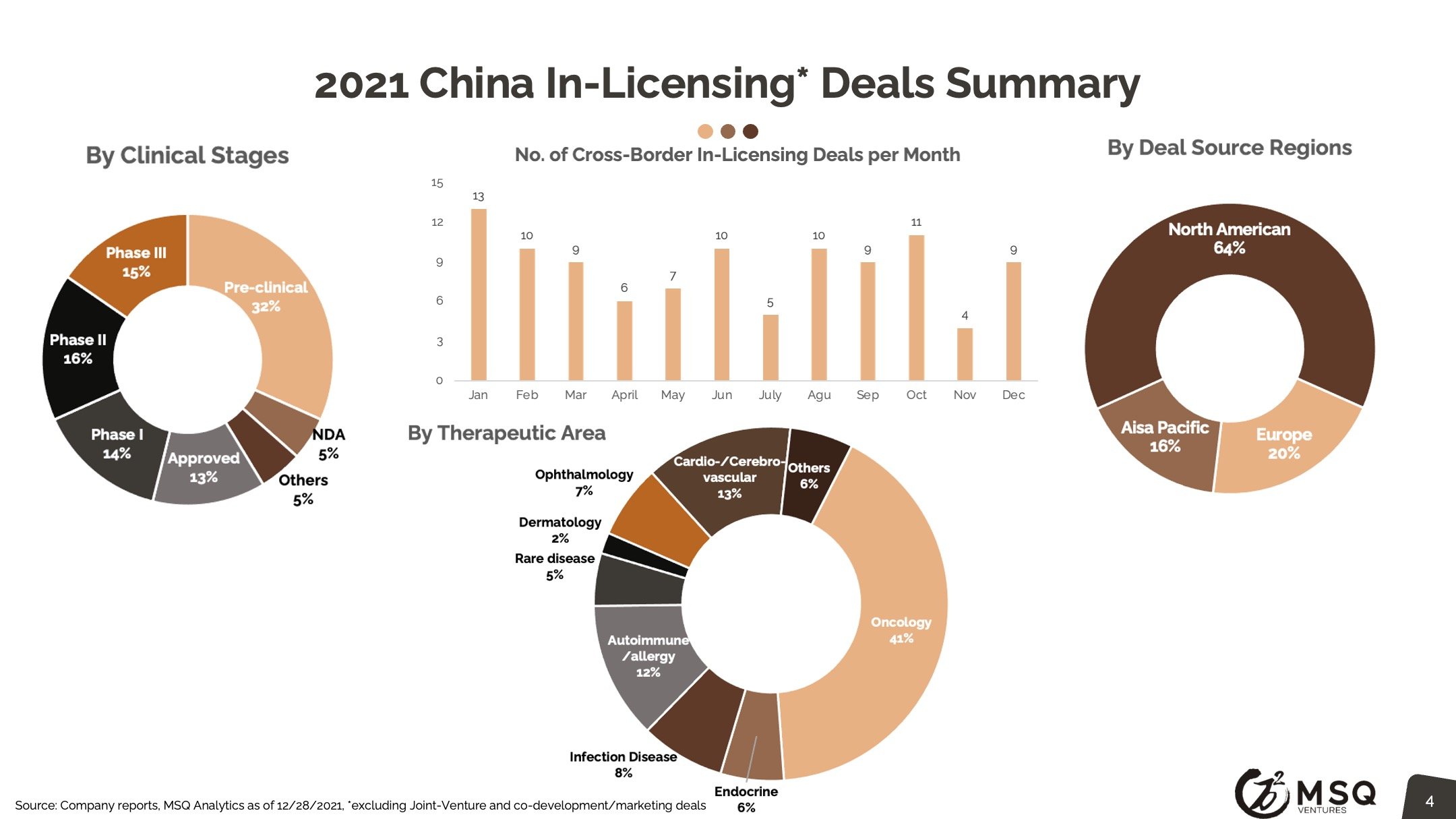

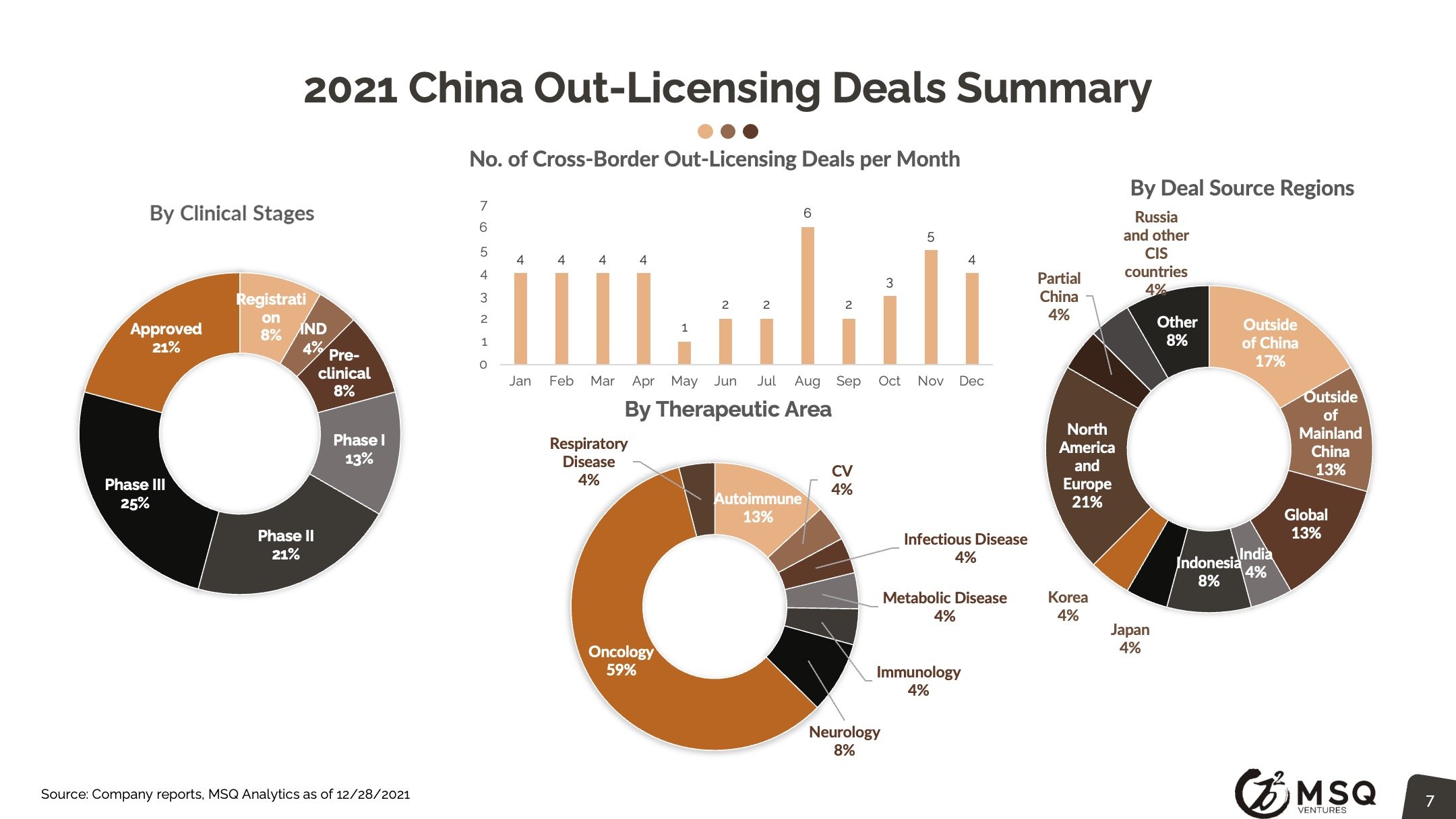

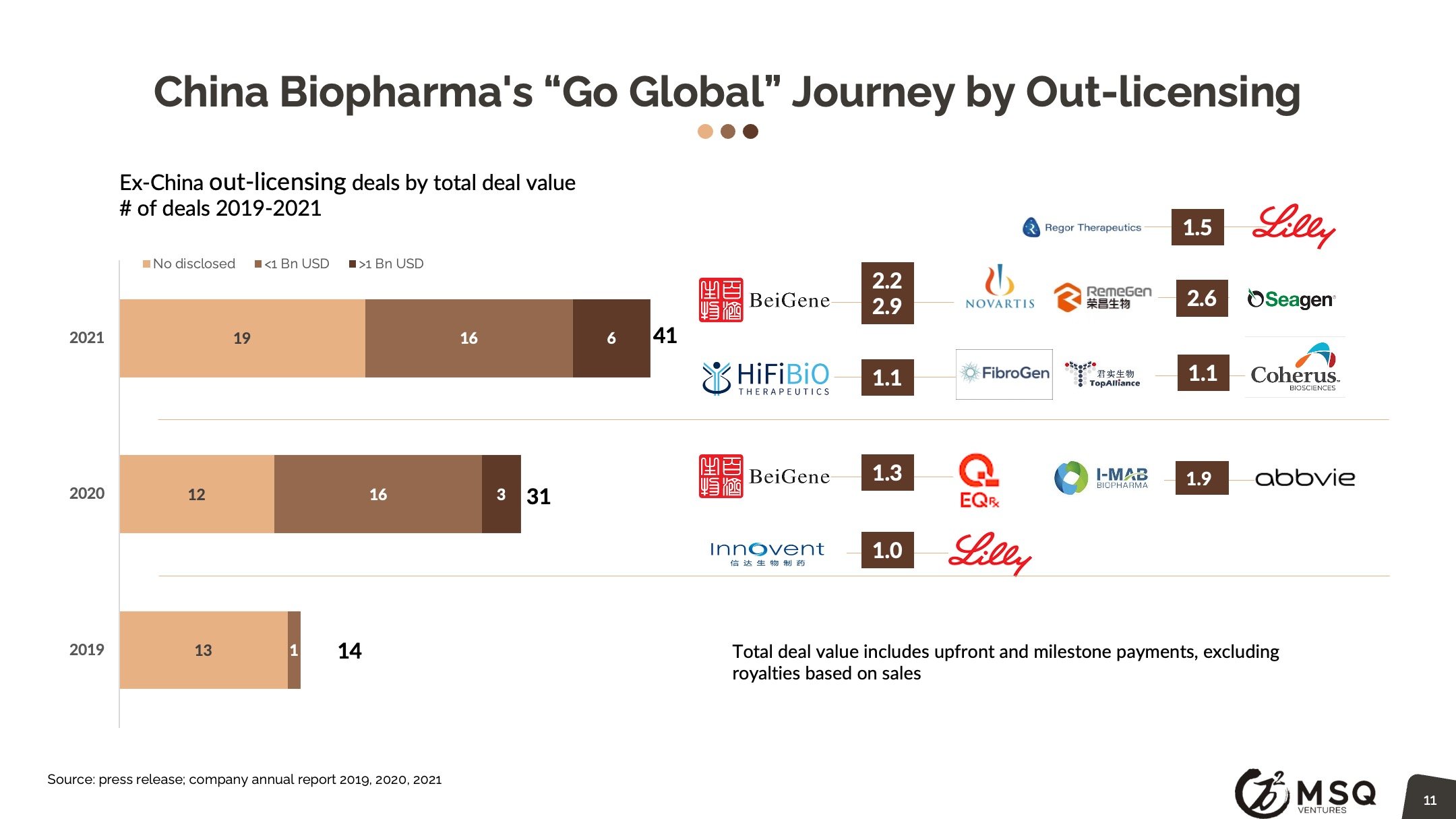

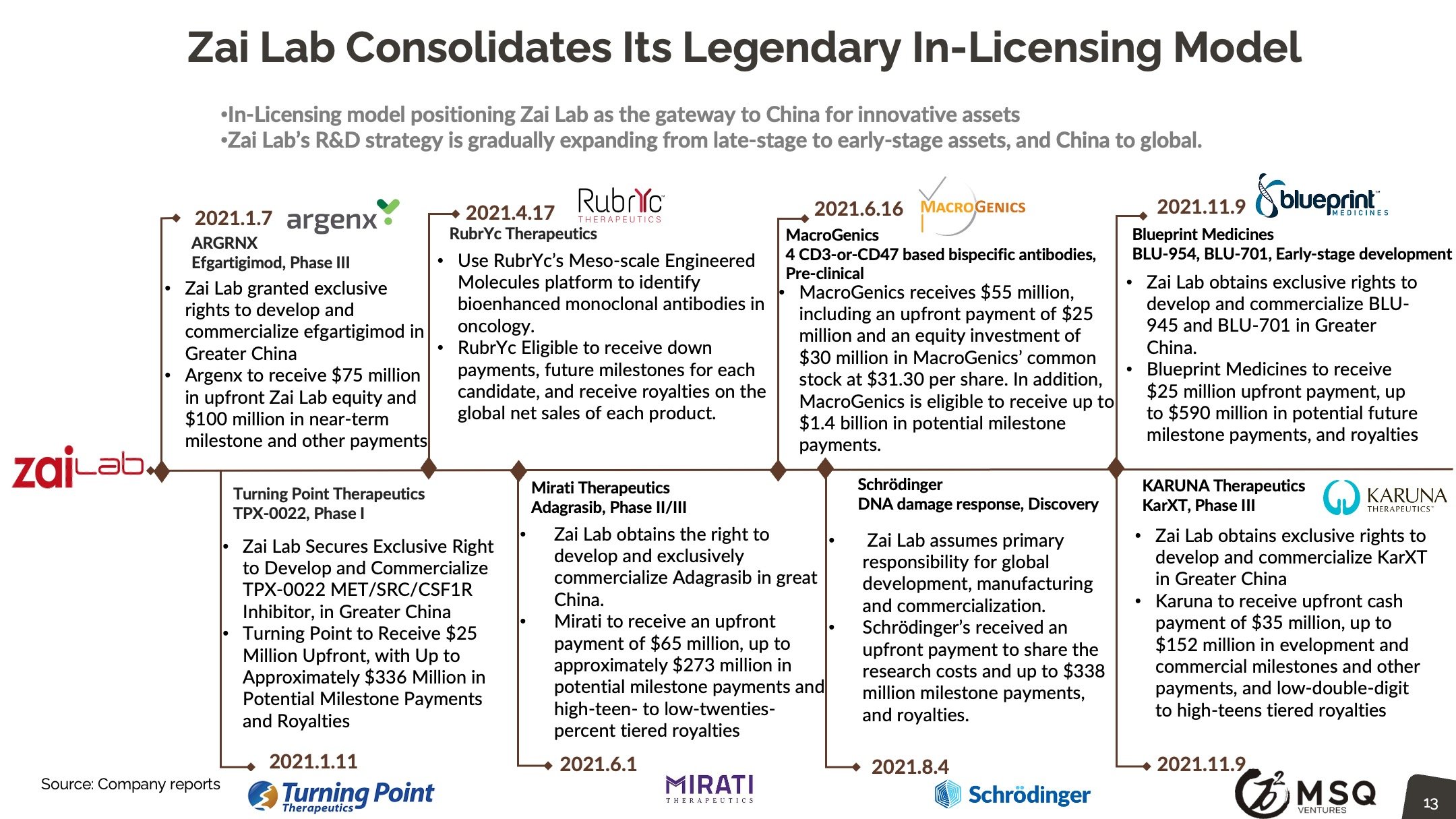

The cross-border licensing scope has become more diversified. The in-licensing efforts remain strong, with more than 100 closed deals in 2021. It is exciting to see an increased number of Chinese biopharma who develop the appetite for “licensing for global”, rather than “licensing for China”. The China out-licensing number (41 in 2021 vs. 31 in 2020) has steadily boosted, opening a new era for China biopharma deals transitioning from “China for China” to “China for global”. One major milestone to note was from RemeGen, that marked China's largest-ever licensing-out deal at $2.6 billion.

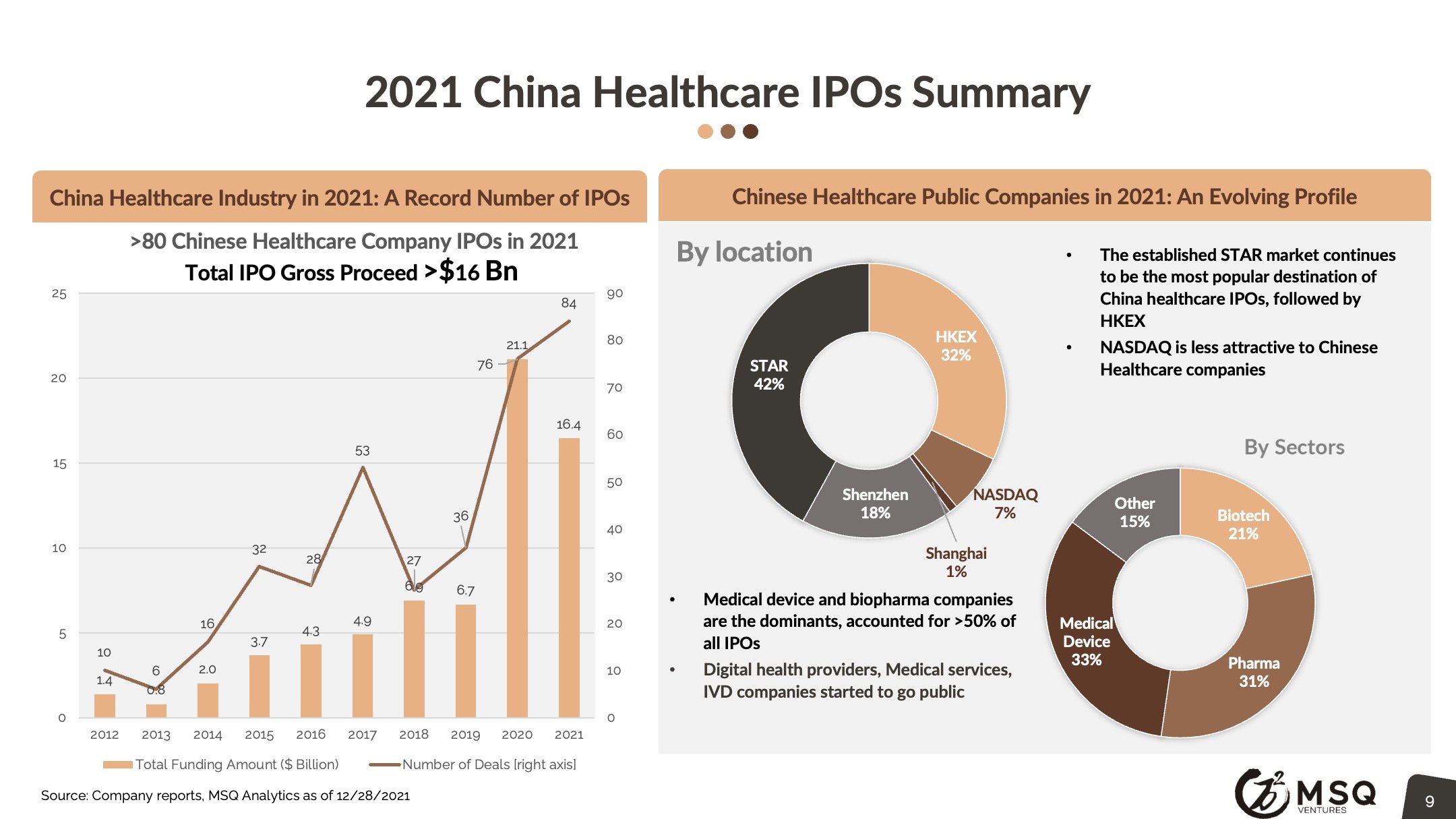

MSQ expects more ex-China VC/PE’s to incorporate a “China angle”, either by direct investing or adopting the "Lianbio Model". We look for China based stock markets to keep up the momentum, driving new waves of IPOs. Top domestic VC/PE players, such as Hillhouse, Qiming, 6 Dimensions continue to develop major activities in China biopharma.

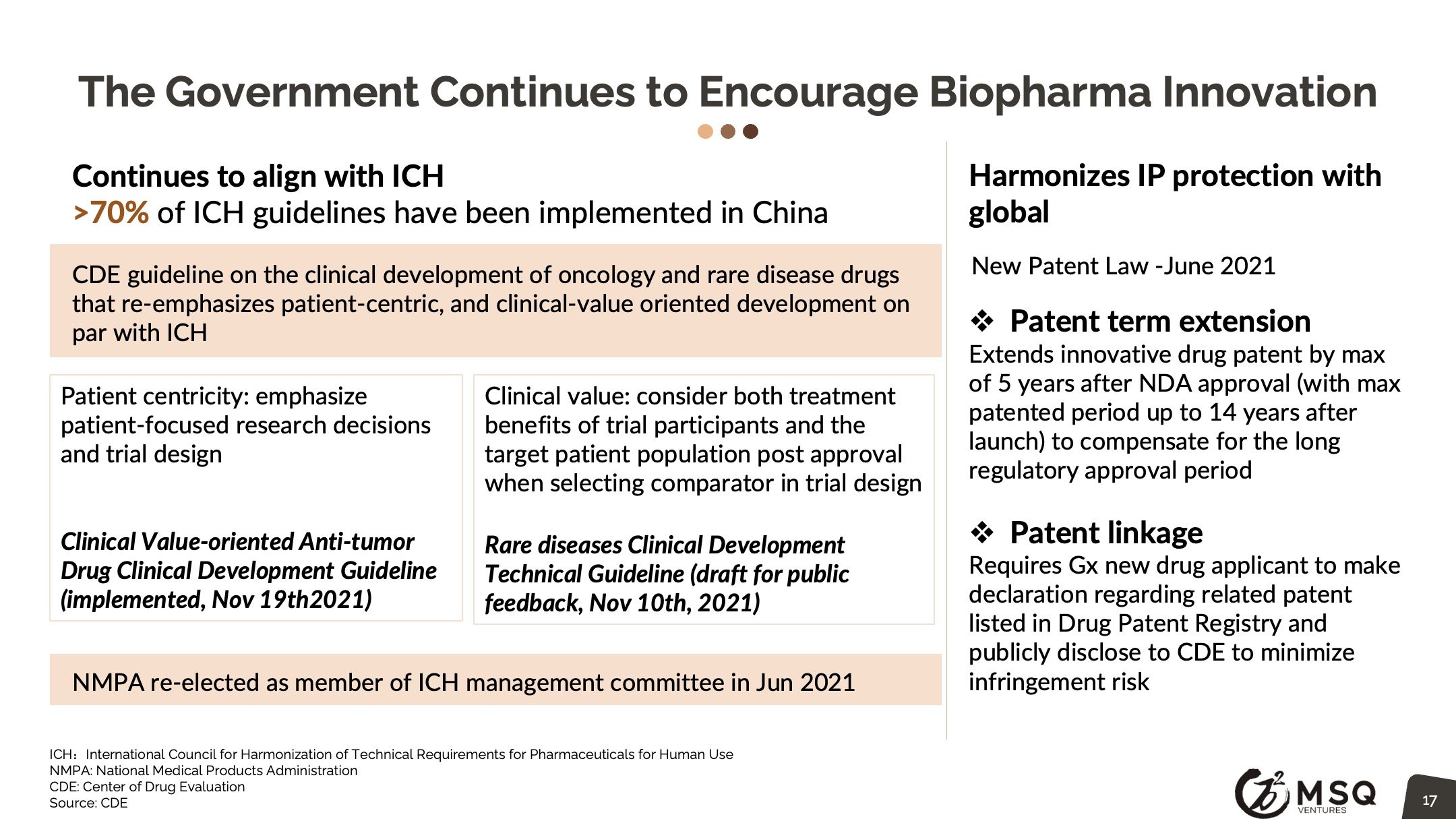

Enforced regulatory policy, particularly in oncology, are setting the bar higher for drug approval and therefore fostering innovation. The Chinese government continues to encourage biopharma Innovation, CDE guideline on the clinical development of oncology that re-emphasizes patient-centric, and clinical-value oriented development to be on par with the ICH. National volume-based procurement continues to expand with significant price cut, posing pressure for traditional pharma to rapidly make the innovation transition. The PD-1 CPI price war discourages the pursuit of me-too drug development.

ICH-standard sites continue to be established in China. Clinical trial data from China is well recognized by FDA for approval. Simultaneous drug development in the US and China is a preferred strategy. The ability to secure FDA IND is key criteria to segregate different tiers of Chinese biopharma. China biopharma’s clinical development activities have tripled in 5 years. Zanubrutinib (BeiGene) received FDA-accelerated approval for MCL based on pivotal data with ~70% of efficacy data from Chinese patients

Looking forward, we expect China biopharma is no longer only a China story, instead, it will grow incrementally and become a major player on the global stage.

As the premium cross-border advisory firm, the MSQ Team will continue striving toward our mission, bringing innovative treatments to patients in need globally.

For more information or questions concerning this report, please contact us at info@msqventures.com