China Biopharma Trend Analysis:

The Race in Ophthalmic Space Heats Up

With the booming of biopharma in China, most of the industry R&D and external collaboration efforts are concentrated in oncology, immuno-oncology in particular. As the intense competition heats up, for example among the PD-1 checkpoint inhibitors, we should keep in mind that no matter how big the cake is, there are only enough pieces, big or small, for a handful of players to share. Thus, as a drug developer, it is wise to be open-minded to embrace other novel and innovative opportunities, both within oncology and other therapeutic areas.

Ophthalmic space is an excellent alternative.

In recent years, due to the increasing number of allergens, unhealthy living habits, the growth of the aging population, the incidence rates of eye diseases like AMD, glaucoma, dry eye disease (DED), myopia have been growing significantly, leading to the rapid growth of China’s ophthalmic drug market: the market size grew at a CAGR of 9.3% from 2015 to 2019 (vs. 5.1% globally), and is expected to grow with the CAGR of 18.6% from 2019 to 2025 (vs. 5.8% globally), significantly outpacing the growth of the global ophthalmic drug market for the same period. In 2021, the market size is projected to reach the US $3.4 billion in 2021.

China has a large but currently underserved patient pool with eye diseases. To put action forward, during China's 2021 Two Sessions, Professor Wang Ningli, a representative of the CPPCC (Chinese People's Political Consultative Conference) and an influential ophthalmologist, stressed that eye health is an essential component of the overall public health, and the government should further explore options that could help provide high quality eye treatment and improve eye health for the whole nation.

One key difference from some other therapeutic areas is that China’s ophthalmic drug market is fragmented. For most domestic biopharma players, ophthalmic drug pipelines comprise only a small fraction of their pharma portfolio, and multinational corporations (MNC) have maintained their dominance of the market. In 2019, MNCs contributed to approximately 60% of the sales of ophthalmic drugs in China. In certain indications, such as DED and glaucoma, the market share of MNC is as high as 75% and 85%, respectively.

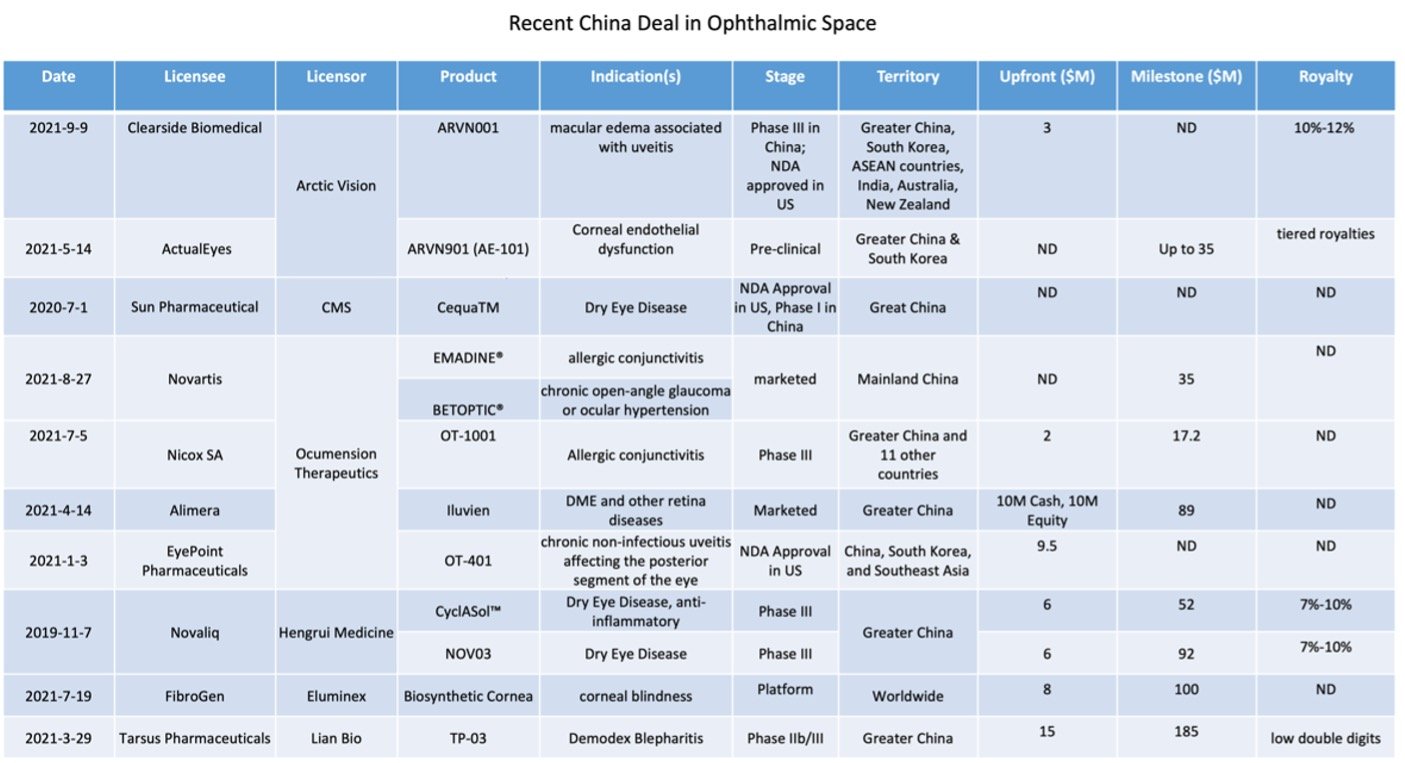

Inspired by the emerging opportunities in China’s ophthalmic drug market, a number of ophthalmology-focused companies were established in the past few years, with the ambition to be the leader in such domain, and quickly developed rich eye disease focused pipelines by extensive in-licensing efforts.

Unsurprisingly, Zai Lab (NASDAQ: ZLAB; HKG: 9688) is the frontrunner of practicing the in-licensing model to accelerate access to global innovation. LianBio (NASDAQ: LIAN) and Everest Medicines (HKG: 1952) also adopted a similar strategy and achieved success. In contrast to these companies, Ocumension Therapeutics (HKG: 1477) and Arctic Vision (private) modified the strategy and decided to solely focus on eye diseases, instead of relatively broad therapeutic areas, which again indicates that the ophthalmic drug market alone in China is big enough to welcome specialized new incomers.

Impressively, it took Ocumension only two years from its debut to be listed on the Hong Kong exchange (HKEX) in 2020 and Arctic Vision plans an IPO in 2022 as well. Interestingly, Ocumension and Arctic Version were backed not only by well-known big names in the biotech industry, such as 6 Dimensions Capital and Morningside but also Tencent (HKG: 0700), indicating a cash injection from all directions.

Unlike Ocumension and Arctic Vision, Zhaoke Ophthalmology (HKG: 6622) is not fully loaded with in-licensing pipelines but rather took a two-pronged approach, and heavily invested in in-house research in parallel. Zhaoke Ophthalmology was listed in HKEX in 2021.

Under the competitive pressure from emerging biotechs, domestic pharmaceutical companies also welcomed external partnerships to supplement internal research. For example, Hengrui Medicine (SHA: 600276) secured exclusive China regional rights to develop, manufacture, and commercialize Novaliq’s (private) NOV03 and CyclASol® in November 2019. One month later, Novaliq successfully out-licensed the US and Canada right to Bausch Health (NYSE: BHC).

Kanghong’s (SHE: 002773) case further serves as a wake-up call to China pharmaceutical companies: it is risky to put all eggs in one basket. After years of investment in Conbercept, Kanghong had to stop the global multi-center clinical trial, which means its highly anticipated core product, Conbercept, has failed to “go abroad”. The stock price fell sharply and has not bounced back. Therefore, Chinese pharmaceutical companies need to build a diversified pipeline to win the ophthalmic drug market, and solely relying on internal R&D is not a practical approach.

Looking into the future, China ophthalmic drug market could follow a similar trajectory of the US market: after a series of M&A, the fragmented marketed will be concentrated by a few big players, the China version of Abbvie (NYSE: ABBV) (Allergan), Novartis (NYSE: NVS), Roche (ROQ.SW), and Bausch Health.

Of course, it is yet to be seen if this newly founded biotech will take over the market, or the old-school China biopharma will eventually win the race owning to their strong capability in manufacturing and commercialization. However, one shared strategy for most the players, if not all, is to take advantage of in-licensing approach, completing the innovation upgrade by external collaborations, especially in the indications with significant market potential, for example, DED, wet age-related macular degeneration (wAMD) and diabetic macular edema (DME).

For more information or questions concerning this report, please contact us at info@msqventures.com